Why Are My Insurance Premiums Rising?

- Professional Risk

- Nov 4, 2019

- 2 min read

Updated: Sep 28, 2021

The Medical Professional Liability Insurance Market has always cycled through periods of hard and soft markets and for over a decade, the industry has been enjoying a soft market. This is characterized by lower insurance premiums for physicians.

While there is no exact science in calculating how long it takes the market to change, there are reliable indicators that help industry experts anticipate these shifts.

We are currently observing market trends indicative of a hardening market, meaning insurance premiums are rising.

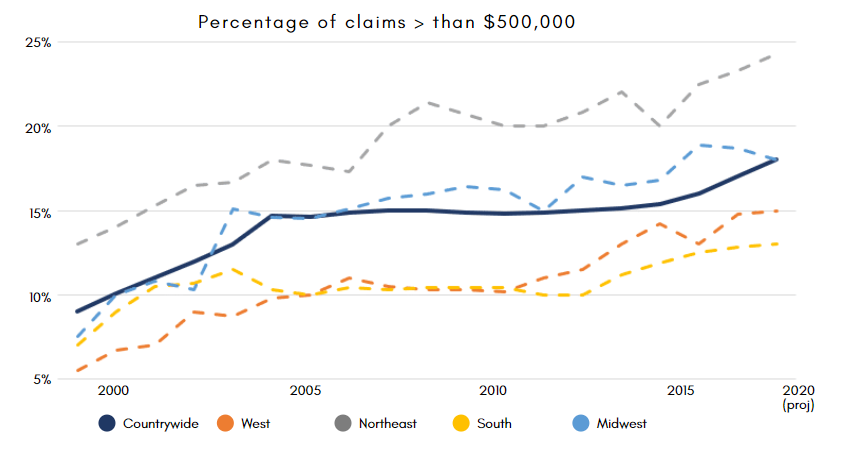

This latest transition is attributed to increased claims severity. While the frequency of claims has declined and now remains stable, there's been a countrywide spike in large verdicts.

With this increase in large payouts, the carriers' reserve funds have started to deplete. In lieu of this financial threat, carriers must now increase rates in order to remain stable and prepare for the hardening market.

In this changing market, you need to start asking about the management tools at your disposal to help counter these changes. Professional Risk offers a variety services and insurance solutions that could help your practice save money during this changing market.

We can help find you affordable coverage options for your other insurance needs with top-rated carriers. These include (but are not limited to):

Cyber Liability

Workers' Compensation

Government and Regulatory Coverage

Business Owners Policies

Management Liability Insurance

Disability and Life Coverage

We also foster risk purchasing groups and insurance programs that provide premium credits to participating physicians. These programs include:

Access Healthcare Direct (NC and National)

Certitude

Ob-Gyn Risk Alliance RPG

Podiatry Risk Alliance RPG

Medical Society of Northern Virginia

Sandhills Physicians Inc.

WVSMA Insurance Program

Northern Virginia Ob-Gyn RPG

Preferred Physicians Medical Group

Our exclusive risk analytics program evaluates your practice's procedures with a national database to help identify the unique exposures your practice faces. We then customize a plan to help address these liabilities. With reduced exposures your practice could improve patient safety and possibly increase revenue.

To learn more about the market changes, or to get more information on any of the money-saving services above, please contact your agent today.

Comments